ev charger tax credit 2022

Unlike some other tax credits this program covers both EV charger hardware AND installation costs. Furthermore Future Energy expects federal tax incentives to be quite robust in 2022.

About Electric Vehicle Charging Efficiency Maine

The maximum costs that are covered are 1000 03 3333 due to the 1000 limit on the credit.

. Sunday April 17 2022 Edit. The federal government offers a tax credit for EV charger hardware and EV charger installation costs. If your home panel is too old to support an EV charger installation then replacing the old panel is also covered in the 30 federal tax credit.

This number varies depending on the capacity of the battery and the vehicles total weight so be. Heres how you would qualify for the maximum credit. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to.

Similar tax breaks have expired and been extended in recent years and in its current form it applies to property placed. SUBJECT Electric Vehicle Charging Station Tax Credit SUMMARY This bill under the Personal Income Tax Law PITL and the Corporation Tax Law CTL would allow a credit equal to 40 percent of the costs paid or incurred by the owners or. For residential installations the IRS caps the tax credit at 1000.

Companies can receive up to 30000 in federal tax credit for commercial installations. Since installation costs are significant for EV chargers this rule allows you to get the most tax credit for your. By Andrew Smith February 11 2022.

Another 500 is added for a US-made. The credit amount will vary based on the capacity of the battery. 1 day agoThe current form of the federal tax credit is up to 7500 for the purchase of a new hybrid or electric vehicle from a manufacturer that has yet to sell 200000 electrified vehicles.

Federal government also has credits and perks for you to take advantage of. Provisions for the electric vehicle charging credit. An additional reduction of the federal tax credit will occur on April 1 2023 with eligible vehicles receiving up to 25 percent of the federal tax credit before being fully phased out in.

The tax credit now expires on December 31 2021. Information specific to your state can be found on the US. The April 7 2021 amendments removed provisions of the bill related to building code.

EV Charging Equipment Federal Tax Credit up to 1000. A rather significant federal tax benefit is available to most taxpayers who recently installed electric vehicle charging stations and it seemingly is a feature that flew under the radar for many. Department of Energys Federal and.

Tax credits allowed by this act meet the goals purposes and objectives of these. As in you may qualify for up to 7500 in federal tax credit for your electric vehicle. Currently the federal government offers a tax credit for both EV charger hardware and for installation costs.

If you installed or plan to install an EV home charger between January 1 2017 and December 31 2021 you can take 30 off the cost of purchasing and installing the charger up to 1000 by claiming a federal tax credit. If so we have great news for you. Congress recently passed a retroactive federal tax credit for those who purchased environmentally responsible transportation including costs for EV charging infrastructure.

As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. Current EV tax credits top out at 7500.

This incentive covers 30 of the cost with a maximum credit of up to 1000. It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs. The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs.

Residential installation can receive a credit of up to 1000. Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022. Another 4500 is available if an automaker makes the EV in the US with a union workforce.

One benefit for you to reap is an income tax credit of up to 75002. For example new EV purchasers may qualify for up to 750 in state tax credits in California in 2022 under the California Clean Fuel Reward program. Following this same estimated timeline beginning October 1 2022 purchases will be eligible to receive up to 50 percent of the federal tax credit 3750.

Co-authored by Stan Rose. So if you recently installed a home EV charging station or completed a large-scale EV infrastructure project you might still be eligible for this. Virginia isnt the only entity that aims to incentivize the ownership of electric models.

The federal government offers a tax credit for EV charger hardware and EV charger installation costs. The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles. The new tax credit starts with a base amount of 4000 as it is today with another 3500 available if the vehicles battery pack includes at least 40 kwh of capacity for cars placed in service before 2027.

You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25. Businesses that install EV chargers are also eligible for the tax credit to a max credit of 30000. The tax credit covers 30 of a companys costs.

Jan 13 2022. The tax credit is retroactive and you can apply for installations made from as far back as 2017. The IRS explains that the federal tax applies to any vehicle purchased after December 31 2009.

Olivier Le MoalShutterstock. This analysis does not account for changes in employment personal income or gross. The federal tax credit was extended through December 31 2021.

Need A Home Ev Charging Station Check Out Your Local Autozone

Rebates And Tax Credits For Electric Vehicle Charging Stations Electric Cars Electric Car Charging Electric Vehicle Charging

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Joe Biden Releases New Ev Charging Plan Protocol

Find Charging Options For Your Electric Vehicle Carolina Country

How To Choose The Right Ev Charger For You Forbes Wheels

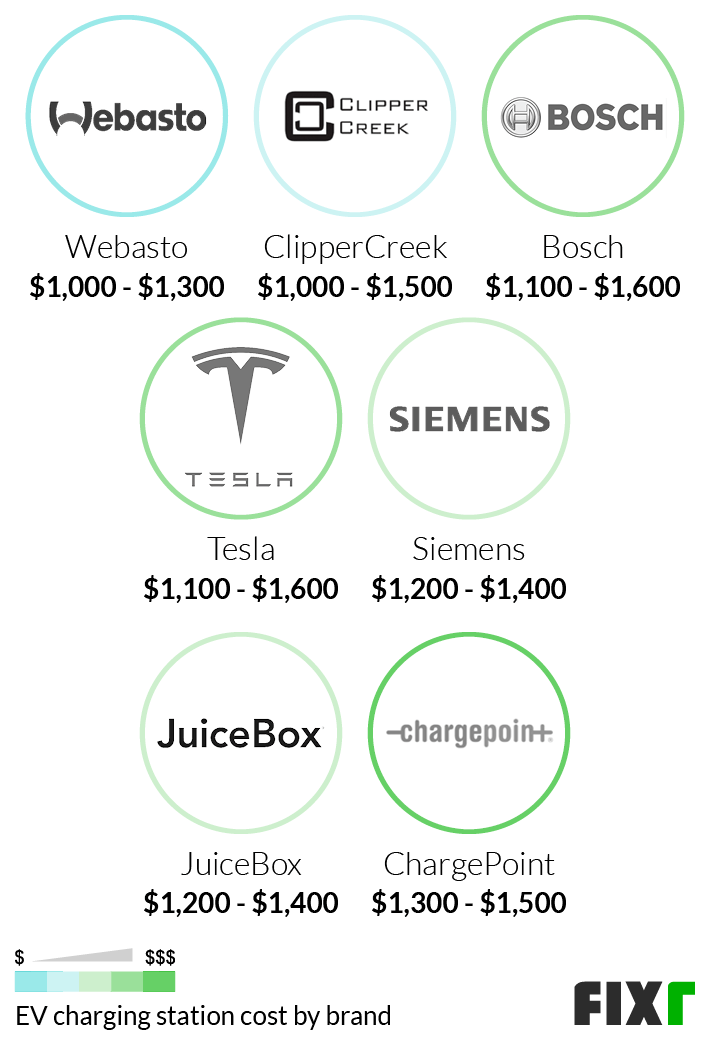

2022 Cost To Install Ev Charger At Home Electric Car Charging Station Cost

Commercial Ev Charging Incentives In 2022 Revision Energy

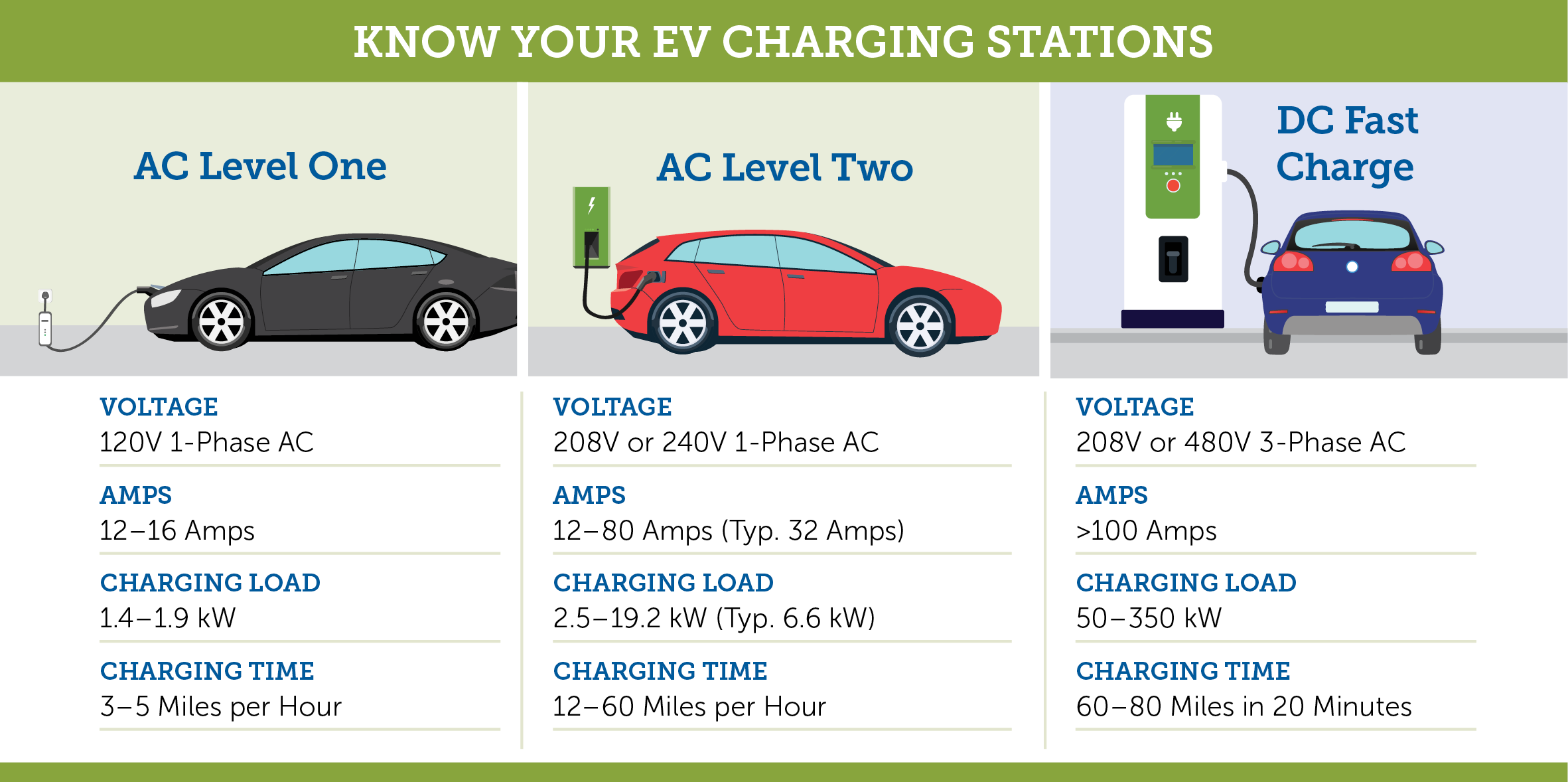

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels

How To Claim An Electric Vehicle Tax Credit Enel X

Ev Charging Stations 101 Wright Hennepin

Uk S New Ev Charging Plan 300 000 Stations By 2030 Protocol

Rebates And Tax Credits For Electric Vehicle Charging Stations

Not Nearly Enough Money For Ev Charging In The Infrastructure Bill

2022 Electric Vehicle Ev Charging Rebates Incentives

Tax Credit For Electric Vehicle Chargers Enel X

What S In The White House Plan To Expand Electric Car Charging Network Npr

Tax Tips For Going Green In 2022 Electric Vehicle Charging Business Advisor Go Green